Retail Business Insurance

Project Background

The RBI team saw an opportunity in the small business insurance space and needed to enhance their online quoting platform. Before I joined IAG, the RBI interface had gone through multiple redesign attempts, which had only resulted in minor UX and conversion improvements.

My Role

As the Lead UX, I could see that this 3rd attempt to redesign the customer experience needed to be about more than just usability improvements and becoming mobile responsive. We needed to redesign the way the business was issuing insurance. I needed to influence my stakeholders to have empathy and start thinking like small business customers, in order to provide a solution that meets their day to day needs.

The Process

Understanding the Problem Space

After spending some time going through the quote and buy process that our customers are exposed to, it was very clear that a custom solution was needed for each occupation. The same quote process was not going to meet the needs of Plumbers and Cafe owners. Electricians had different needs to Farmers.

In addition the tone of voice needed to match each target user, and business questions needed to be specific to each occupation. I also studied the offering of our competitors and that was not any better. Insurance jargon that people outside the industry found difficult to understand was used and often internal business processes were exposed to customers.

We already had a good understanding of our user groups, and persona’s had already been developed in the research conducted during attempt 2 of the redesign, by our external UX agency. Their work however stopped at usability improvements. They did not question the way business was issuing insurance. As a external agency you have very little impact on deep underlying rules of a client’s business. The advantage I had as a internal UX architect was my access to various departments within IAG and ability to influence stakeholders.

My first personal goal was to help my own bosses understand that changing the way business is conducted or “designing the organisation” is just as much a part of User Experience, as is the experience design and usability of the final product.

The RBI group needed help through this process and the best person to guide them would be a UX practitioner.

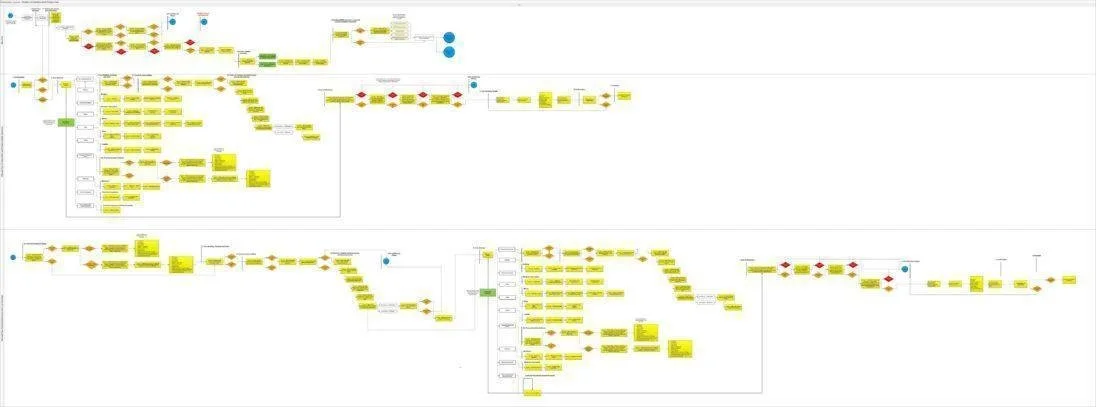

Process Mapping

I mapped out the full quote experience across six A3 sheets of paper, and this exercise alone exposed the length and complexity of the process to major stakeholders. The full online process had never been mapped out and no one really had a picture of it in their minds except the developers who had built it.

I went through each step of the quote process with my business owners and questioned the necessity and relevance to our users. It became very obvious early on that many of the questions customers were being asked were not necessary for the quote and in some cases were not used at all by the business! In fact one stakeholder admitted that the questions were asked “just in case” they may be needed in the far future, but after further probing, it became clear that the customer answers were not ever used by the business. In other words customers were being asked to jump through hoops unnecessarily, making the quote process longer than it needed to and leading to drop-offs.

Defining the MVP

By this stage the business were eager to simplify the journey for their users and improve their overall online customer experience.

The biggest user group were Plumbers so it was decided to focus on that persona initially, release, test and learn.

Afterwards the same improvements could be made incrementally across the other occupations. Narrowing down the target audience to the biggest customer base meant that we could make the most impact on conversions.

Research

Interviews with frontline staff about the pain points of these customers exposed their biggest complaint. They found insurance speak confusing! And the majority of these tradesmen would assign the purchase of business insurance to their wives or office managers. In order to test this assumption, we needed to interview these users ourselves.

It was impossible to book 1 on 1 interviews with these tradesmen during office hours, so myself and a designer travelled to their workplaces, homes and wherever else they could meet us. We needed to hear their concerns and challenges as small business owners. We also watched them go through the current RBI quote online to see were the problems occurred.

Redesigning the Process

I removed all the questions that were not relevant for Plumbers and rephrased those that were necessary, in language that was friendly and helpful. For example, Plumbers don’t need glass cover, given they do not have shop fronts. It was also important to move the knock out questions to the beginning of the process, as those answers determine whether a customer is eligible for insurance or not. I did not want someone who had no chance of getting insured spending 15 minutes filling in a form.

Through 5 workshops with my stakeholders (senior managers, portfolio owners, head of UX, business analysts, platform developers), I ran through every step in the quote and buying process, and outlined the current ux issues and proposed solutions.

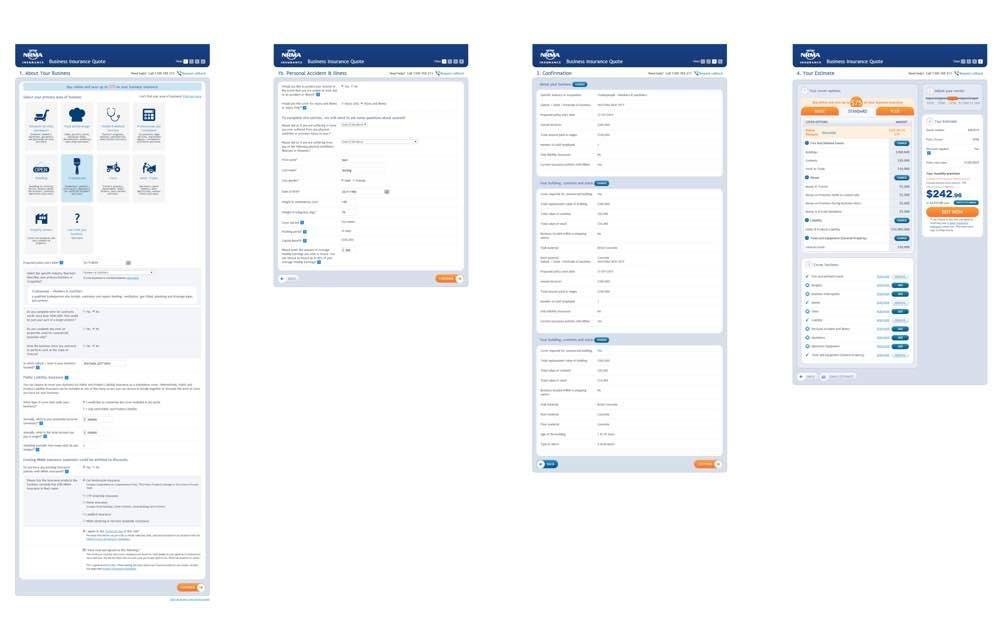

Designing the Interface

Once the list of questions was refined, I worked closely with our interaction designer to develop the responsive designs, in line with our Global Experience Language (GEL). In the process of developing the screens, we then helped improve the GEL, which benefited other projects in digital IAG.

The new designs were prototyped and put infront of Plumbers to validate the interface enhancements before development began.

I then worked closely with the developers to build the responsive experience while also enhancing our UI patterns library for future projects.

Project Conclusion

The number of questions was reduced, the process simplified, the interface modernised and made responsive, the tone of voice improved to match the target audience, and the internal insurance jargon was removed.

The time to complete a quote went from 19 minutes to 10 minutes.

The retail business scrum team are now completing the development. The digital UX team are using the new GEL developed through this project to refresh the other quoting experiences.